-

Best Forex Brokers

Our top-rated Forex brokers

-

No-deposit Bonuses

Live trading with no deposit

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

TZS Trading Accounts

Save on conversion fees

-

Islamic Account Brokers

Best accounts for Muslim traders

-

ECN Brokers

Trade with Direct Market Access

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader 4 Brokers

Top MT4 brokers in Tanzania

-

MetaTrader 5 Brokers

Top MT5 brokers in Tanzania

-

cTrader Brokers

Top cTrader brokers in SA

-

Best TradingView Brokers

The Top TradingView Brokers

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, CIMA |

| 💵 Trading Cost | USD 5 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, WebTrader |

| 💱 Instruments | Bonds, Commodities, Stock CFDs, Forex, Indices, Interest Rates, Metals |

Last Updated On May 10, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on CityIndex

City Index is one of several brokers that pre-dates the internet and the subsequent online boom. A traditional market maker, now owned by NYSE-listed GAIN Capital, it represents very good value for beginner brokers, with tight spreads on cheap accounts and a varied platform choice including MT4 and AT Pro – an advanced automated trading platform with deep customisation and back-testing.

In addition, City Index’ education section is perfect for beginners who want to get up to speed quickly and customer service is open 24/5. Overall, a good market maker broker and competitive with traditional brokers of its size and type.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, CIMA |

| 💵 Trading Cost | USD 5 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, WebTrader |

| 💱 Instruments | Bonds, Commodities, Stock CFDs, Forex, Indices, Interest Rates, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

- Excellent market analysis

- Low deposit and tight spreads

Cons

- Slow withdrawals

- Limited demo account

Is City Index Safe?

City Index was founded in 1983 in London and started offering CFD trading in 2001. In 2014 City Index was purchased by GAIN Capital, a large US multinational which has been listed on the NYSE since 2010 and posted revenues of 328 million USD in 2018.

City Index and it’s subsidiaries have oversight from no less than eight regulators, including the UK’s FCA (Licence Number: 113942) since 2001 and Australia’s ASIC (ASFL 345646) since 2010. All customer funds are fully segregated from City Index capital and are held by secure tier 1 banks. Additionally, City Index is a co-founder of the Australian CFD and FX Forum, which works to continuously raise industry standards to fully protect all clients’ funds.

City Index has certainly received its share of industry recognition, with recent highlights being the Best Trading Platform and Best Mobile Application Awards (OPWA Awards 2019) and the Best CFD Provider Award at the 2019 ADVFN Awards.

Trading Conditions

City Index offers over 84 currency pairs to trade and spreads are competitive with similar brokers.

Account Types

Like other large market maker brokers, City Index only has one live account and one demo account.

Demo Account

Unfortunately, the demo account at City Index has a 12-week limit – an unusual choice for a large broker – and only comes with 20,000 AUD/10,000 GBP of virtual money, though we imagine the customer support team would increase this limit if asked.

Otherwise, City Index’ demo account has all of the features and platform choices of the live account and is a good way to learn more about City Index as a broker.

Live Account

The live account has no minimum deposit and spreads are better than most market makers – from 0.5 pips on major pairs; both fixed and variable spreads are available. If you keep an account balance of more than 10,000 USD you can unlock the Premium Trader tier, which will grant you access to hospitality events and on-one-one customer service.

The maximum leverage currently offered is 500:1, though in the UK and EU expect maximum leverage of 30:1.

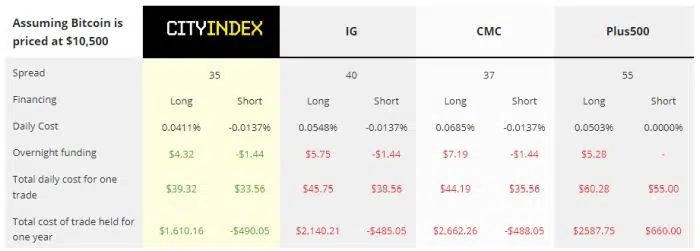

Cryptocurrency CFDs

City Index offers crypto CFD trading in Bitcoin, Ethereum, Ripple and Bitcoin Cash. This set of cryptocurrencies will keep beginner traders happy but is relatively limited compared to other large brokers. That said, City Index does have the lowest Cryptocurrency trading fees amongst their immediate competitors.

Spreads on Crypto vary and will be much wider than for Forex – due to the extreme volatility of the Crypto market. Leverage for these products is set at 4:1.

Deposit Withdrawal Fees

CityIndex accepts deposits and withdrawals via:

- Credit Card

- Debit Card

- EFT

- BPAY

- PayID

No fees are charged for deposits or withdrawals. Withdrawals are processed within three working days and card withdrawals can take up to 10 working days to reach the customer.

City Index for Beginners

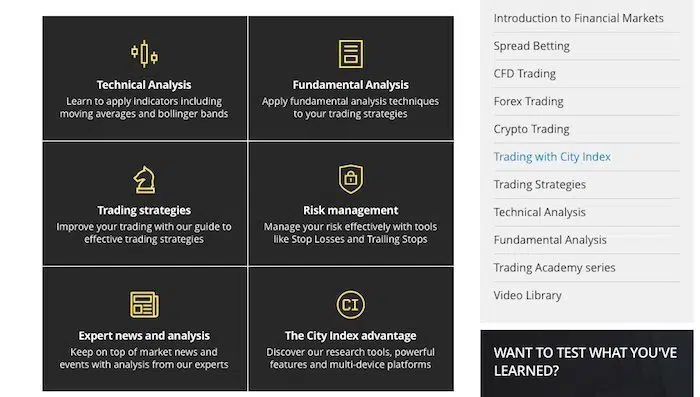

City Index has a large, dedicated training section for new traders, but as it is a multi-asset broker, the focus isn’t always on Forex trading. Similarly, the Market News & Analysis area is comprehensive and useful, but again, the focus is distributed across all the asset classes available at City Index.

Education Material

The educational material offered at City Index is good but only adequate for a broker of its size and type. Under the Training tab on the website, you will find links to short, detailed courses on Technical Analysis, Fundamental Analysis, Trading Strategy and Risk Management – there is also a small video library covering common Forex topics.

A more in-depth multimedia course called Introduction to Trading will be useful for beginners who want to get up to speed as quickly as possible.

Analytical Material

Under the Market News & Analysis tab, you will find a section devoted to daily research and fundamental analysis of news events. This is updated frequently by a small team of City Index analysts and covers all the asset classes tradeable at City Index. Articles can be filtered by topic, author and asset class so finding relevant Forex news and analysis is not difficult. Also in this section is a fairly basic Economic Calendar covering all the known economic events.

City Index also hosts webinars, though not frequently and you will need to be an active customer in order to register for them. Overall, a fairly underwhelming analytical section, especially when compared to other large brokers such as CMC Markets or Plus500.

Customer Support

Customer support is open 24/5, via live chat, email or phone. This is complemented by an extensive FAQ section covering account management, platform tutorials, funding and withdrawals, financial terms and the costs of trading.

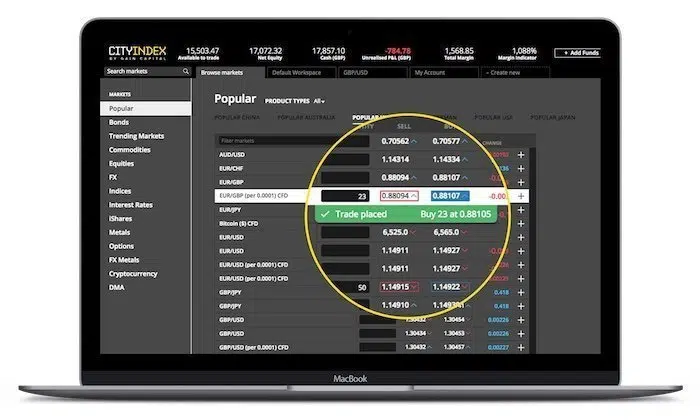

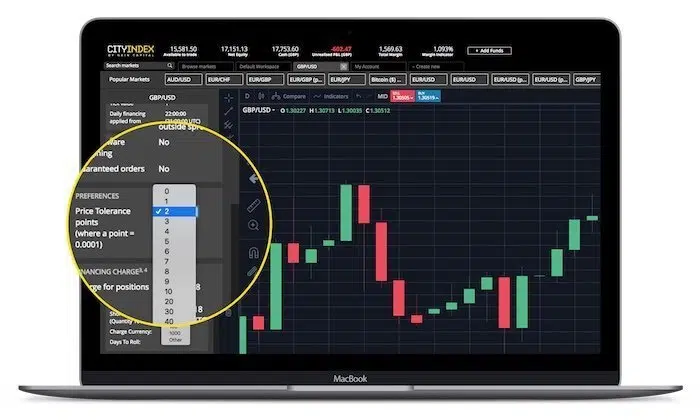

Trading Platforms

City Index offers a variety of platforms to traders: Two downloadable platforms – AT Pro and MetaTrader 4 – and the browser-based Web Trader. In addition, City Index also offers mobile applications (Advantage iOS and Advantage Android), All of these platforms have different advantages:

- Web Trader: This web platform offers great charting tools and other trading features, but it is limited compared to the downloadable platforms. The research portal is a nice touch, and something other platforms that are more execution-focused don’t offer.

- MetaTrader 4: This is the first choice of platform for CFD traders. The interface does look dated and it does not offer as much customisation as some advanced traders might like. That said, it is an excellent all-rounder.

- AT Pro: AT Pro is aimed at experienced traders who want to take advantage of automated trading, it allows users to create their own trading templates in C#, .NET and Visual Basic. A powerful back-testing tool is also built-in as well as dozens of pre-made templates.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the City Index offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

City Index Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. City Index would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with City Index. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Conclusion

Large, established and well-regulated – City Index is not dissimilar to their market maker peers, CMC Markets and Plus500. Tight spreads (for a market maker) and great platform choice help City Index stand out, though its education and analysis sections are underwhelming. We would also like to see one or two more account options, but overall City Index is a good choice if you are looking for a large and established market maker.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how CityIndex stacks up against other brokers.