-

Best Forex Brokers

Our top-rated Forex brokers

-

No-deposit Bonuses

Live trading with no deposit

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

TZS Trading Accounts

Save on conversion fees

-

Islamic Account Brokers

Best accounts for Muslim traders

-

ECN Brokers

Trade with Direct Market Access

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader 4 Brokers

Top MT4 brokers in Tanzania

-

MetaTrader 5 Brokers

Top MT5 brokers in Tanzania

-

cTrader Brokers

Top cTrader brokers in SA

-

Best TradingView Brokers

The Top TradingView Brokers

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Last Updated On Feb 8, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Pepperstone

One of our highest rated brokers for Tanzanian traders, Pepperstone was founded in Australia in 2010 and is globally renowned for its low trading costs and choice of trading platforms. Pepperstone keeps costs low with some of the tightest spreads we’ve seen, starting at 1.00 (EUR/USD) on its Standard Account. For those who prefer classic ECN trading, the Razor Account has low commissions and spreads averaging at just 0.10 pips on the EUR/USD. Neither account has a required minimum deposit.

Despite the low costs, we are disappointed with Pepperstone’s complicated commission structure. But more experienced traders will appreciate Pepperstone’s trading platform options, including MT4, MT5, and cTrader, which integrates seamlessly with the TradingView tool. All are available on desktop and mobile devices. Pepperstone’s education section is not the most extensive we’ve seen, but it is competent and well-structured, making it a good place to start for beginner traders.

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | ASIC, CySEC, BaFin, CMA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader, TradingView |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices, Metals, Energies |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Great platform choice

- Wide range of assets

Cons

- Limited market analysis

Is Pepperstone Safe?

Yes, Pepperstone is a safe broker for Tanzanian traders to trade with, since Pepperstone has a long history of responsible behaviour and strong international regulation.

Regulated in Kenya: On signing up, we found that Tanzanians are onboarded through Pepperstone’s Kenyan-based entity, regulated by the Capital Markets Authority (CMA).

Unfortunately, the CMA is not as good a regulator as the FSCA or ASIC, which means that Tanzanian traders will not be as well protected.

Safety Features: Pepperstone has a reputation for treating its clients fairly and holds licences from many excellent regulators from around the world. It also provides all clients with negative balance protection which means that traders cannot lose more than their initial deposit. On this basis, we consider Pepperstone a safe broker to trade with.

Company Details:

Pepperstone’s Financial Instruments

On top of 90 Forex pairs, Pepperstone has currency indices that are hard to find at other brokers. But we were disappointed to find that Pepperstone has fewer shares to trade than most other large brokers and no longer offers crypto trading to Tanzanian traders.

Pepperstone offers a similar range of instruments as other brokers but offers a wider range of Forex pairs. Since regulated by the CMA, leverage is 400:1 on major Forex pairs.

Forex: Pepperstone offers 90 currency pairs for trading, more than most other Forex brokers.

Share CFDs: Pepperstone offers 1000+ share CFDs, including 600+ US stocks as well as a selection of UK, German and Australian blue chips. Note that share CFDs are only available on the MT5 platform.

Commodities: Pepperstone offers 17 commodities, including gold, silver, platinum, petroleum, natural gas, and softs such as coffee, cocoa and orange juice.

Indices: Pepperstone offers trading on 28 indices including the likes of the NASDAQ, FTSE100, DAX30, Hang Seng, and even the Johannesburg Stock Exchange.

Currency Index CFDs: Currency indices track the value of a currency against a basket of other currencies. This differs from a currency pair in that there must be more than one other currency that the main currency is being measured against. Currency indices available include the USD index, EUR index, and JPY index.

Accounts and Trading Fees

Pepperstone has two accounts with very low trading costs compared to other brokers, and neither trading account has a required minimum deposit. Commissions on the Razor Account were difficult to determine as they are calculated differently on each of the three trading platforms.

Trading Fees: Neither the Standard Account nor the Razor Account has a required minimum deposit, though we recommend starting with a minimum of 200 USD to avoid margin calls. Trading costs on both accounts are much lower than most other brokers.

Account Trading Costs:

![]()

![]()

As you can see from the table above, the trading costs on the Standard Account are built into the spread and are slightly lower than the costs on the Razor Account, which has a small commission that changes depending on which trading platform you use. Commissions are also affected by the base currency of your account on the MT4 and MT5 platforms and what currency pair you are trading on the cTrader platform.

Tight spreads on Forex pairs: Pepperstone also offers tight spreads on all other major pairs, including the GBP/USD, USD/JPY, AUD/USD, and USD/CHF. As with the EUR/USD above, the costs in the table below are based on the trading fees of one lot (100 000 USD), including the spread and commission. The following spreads are based on the Standard Account and were taken directly from the MT4 platform:

Spreads on Major Forex Pairs:

![]()

![]()

Pepperstone Standard Account

This commission-free trading account has no minimum deposit requirement. Costs are included in the spreads, which average at 1.1 pips on the EUR/USD. This account is one of the lowest-cost trading accounts in the world and is especially good for beginner traders who do not want to spend time calculating commissions.

Pepperstone Razor Account

Pepperstone’s raw spread account is the Razor Account and has no required minimum deposit. Spreads average at 0.10 pips on the EUR/USD – which is the lowest average spread we have found at ANY broker – and a commission is charged per lot traded. Commissions change depending on your trading platform, the base currency of your account, and your trading volume. We confirmed this spread on the cTrader platform:

Razor Account Commissions

MT4 and MT5: Commissions on the MT4 and MT5 Razor Accounts are charged in the base currency of your account. We noticed how cheap the commissions are for traders with an AUD base currency when we opened our account. Given that (as of May 2022) the USD/AUD is currently at 1.41, the commission cost per lot with an AUD base currency is the equivalent of 4.98 USD – a saving of around 2 USD per lot when compared to an account with a USD base currency.

cTrader: The commission structure for cTrader Razor Accounts is based purely on what currency pair you are trading. The cTrader Razor Account commission is always 0.007% (round turn) of the base currency that’s being traded. So, if you’re trading 100,000 USD/CHF the commission will be 3.50 USD to open the trade and 3.50 USD to close the trade.

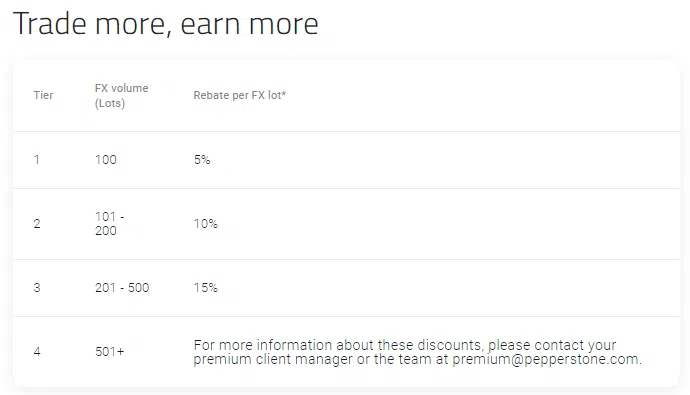

Active Trader Program

Trading commissions can be further reduced by becoming a member of Pepperstone’s Active Trader Program. The Active Trader Program has several advantages for high-volume traders, including discounted commissions, a free VPS service and priority customer support. The commission discount with the Active Trader Program features 4 tiers as follows:

For more information about tier 4 of the Active Trader Program, traders should contact Pepperstone customer support.

Deposits and Withdrawals

Pepperstone generally charges no deposit and withdrawal fees, though it does lack transparency when it comes to funding methods and costs. .

As a well-regulated broker, Pepperstone ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all non-profit withdrawals are returned to the deposit source.

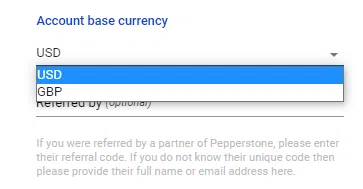

Accepted Deposit Currencies: Accounts can only be opened in USD or GBP. Because the Tanzanian Shilling is not one of Pepperstone’s accepted base currencies, Tanzanian traders will have to pay currency conversion fees. Pepperstone charges currency conversions at the current spot rate, minus a conversion fee of up to 1 percent, which is relatively high.

Funding Methods and Fees: Pepperstone offers a range of fee-free deposit and withdrawal options; however, a fee of 20 USD is charged by Pepperstone for international bank transfers; and withdrawals through Skrill or Neteller cost 1 USD. We tested deposits via credit card and found that our payment was processed instantly. It took 2 days for us to withdraw our money, which is around the industry average.

See below for a complete list of payment options and withdrawal times:

![]()

![]()

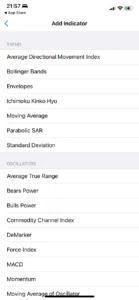

Pepperstone’s Mobile Trading Apps

Pepperstone does not have its own trading app, but MT4, MT5, and cTrader are all available as mobile apps. We found the cTrader app easier to use than MT4 and MT5 as it has a more modern design and it integrates with TradingView.

All three of Pepperstone’s trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, and poor mobile connections seriously impact trading.

cTrader App

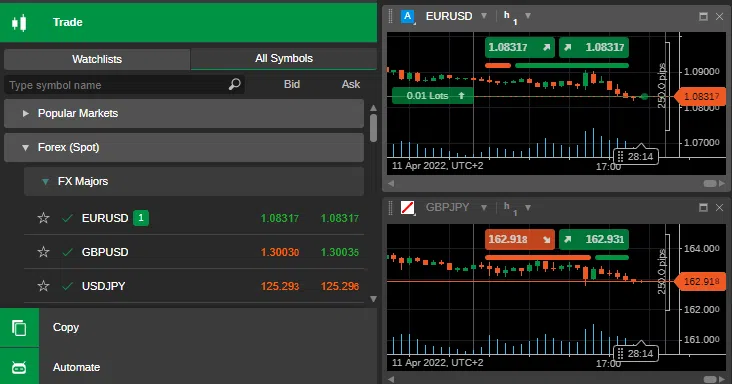

cTrader is one of our favourite trading platforms, and Pepperstone is one of a handful of brokers that supports it. Its clean design makes it easy for beginners to pick up, but it also has the advanced order types and automation options required by more experienced traders. The Pepperstone cTrader app keeps most of the best parts of the desktop version, including the complete range of order types, price alerts, trade analysis, and symbol watchlists. It also integrates seamlessly with TradingView, an advanced charting tool:

TradingView

TradingView is free of charge for traders who open a live account. It is an excellent tool for researching, charting, and screening any instrument. Additional features of Pepperstone’s TradingView tool include:

- 50+ intelligent charting tools

- Over 100,000 custom user-built indicators and scripts

- Synchronised layout for multiple charts

Traders should note that TradingView is only available on the Razor Account.

MT4 and MT5 Apps

The Pepperstone MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further assists traders while on the move.

Pepperstone’s Other Trading Platforms

With MT4, MT5, and cTrader all available, Pepperstone offers support for more trading platforms than most brokers. Additionally, Pepperstone’s cTrader integrates with TradingView, adding advanced functionality.

Pepperstone offers traders MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each of which offers Expert Advisors, automated trading support, strategy backtesting, customisable charting, indicators, and copy trading functionality.

All platform choices are free to use, all can be downloaded to your PC or Mac, and all have web versions of the platform. Traders who want more EAs to use, and don’t mind the dated interface, should consider using one of the MetaTrader products. cTrader is often a favourite for beginner traders as it requires less setup, has a more modern interface, and offers more advanced order types. Pepperstone’s cTrader also seamlessly integrates with TradingView, an advanced charting tool.

All three trading platforms offered are considered among the best in the industry, and all three provide access to Autochartist, one of Pepperstone’s range of free trading tools. While Pepperstone does not have its own proprietary platform, which is usually easier for beginners to learn, the choice of any of the three major platforms will keep most traders satisfied.

Trading Platform Comparison:

Opening an Account at Pepperstone

Opening an account at Pepperstone is a fully digital process but does require a suitability assessment that many other brokers do not carry out.

All Tanzanian residents are eligible to open a trading account at Pepperstone but will have to follow the fully digital four-step application process. Once the process is complete, Pepperstone aims to approve applications within 4-8 hours.

How to open an account at Pepperstone:

- Create your login via the Pepperstone website, you will be asked for your email address and asked to choose a password.

- The second step is to take the Pepperstone suitability test. This short questionnaire is used by Pepperstone customer service to assess whether trading CFDs is appropriate for you. While most brokers omit this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- The third step is to confirm your identification. Pepperstone will need two ID documents from you; the easiest way to provide these documents is to take a photo of them with a mobile phone:

- A photo ID (passport, driver’s license or ID card) and;

- A secondary ID (a bank or utility statement with your full name and address dated in the last three months).

- Important: Pepperstone will not accept ID documents that are black and white images, scanned copies, blurry or damaged.

- Once your application is approved, you can log in and fund your account in the base currency of your choosing.

Compared to other similar brokers, Pepperstone’s account opening process is fast, generally hassle-free, and fully digital. The only issue that some traders may have is the suitability assessment test, though this is a responsible move on Pepperstone’s part that protects the funds of those unsuited to high-risk investments.

Pepperstone Trading Tools

Pepperstone’s trading tool options are above average when compared to similar brokers, with free Autochartist for all traders and Smart Trader Tools for MT4 and MT5.

Smart Trader Tools for MetaTrader4/5

At Pepperstone, MT4 and MT5 traders can benefit from this dedicated suite of 28 tools, expert advisors, and indicators. Smart Trader Tools help traders manage their risk, control all trades from a single terminal and view the correlations between currency pairs and other CFDs. The full set of tools includes sophisticated alarms and broadcast facilities, with up-to-date market data and functions integrated within the MetaTrader interfaces.

Autochartist

Free for all Pepperstone clients, Autochartist is an award-winning automated technical analysis tool that plugs into MT4, MT5, and cTrader and scans all available CFD markets for trading opportunities. Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements.

API Trading

Pepperstone supports trading via its Application Programming Interface (API). This technology is ideal for those using trading systems or developing their own custom-built system. It allows an increased ability to see the depth of market and access to multiple liquidity providers.

Discounted VPS Services

Via two third-party companies (ForexVPS and New York City Servers), Pepperstone offers a discounted VPS (Virtual Private Server) service for traders using the MT4 and MT5 platforms. VPS hosting allows traders to run automated algorithmic strategies, including expert advisors, 24 hours a day, 7 days a week on a virtual machine.

Both ForexVPS and New York City Servers have dedicated 24/5 customer support teams to help new users set up and install EAs and indicators directly to the virtual machines. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

Pepperstone Social Trading

While Pepperstone does not offer a dedicated social trading platform, it offers support for both the Metatrader Signals marketplace and Duplitrade, a popular third-party trading strategy marketplace that allows you to automate your trading by following proven expert traders.

While MetaTrader Signals can be followed by anyone using the Metatrader platform, the Duplitrade copy trading system is only accessible through Pepperstone with a 5000 USD (or equivalent) minimum deposit.

Pepperstone’s Education

Pepperstone’s education section is better than most other ECN brokers but falls short of the best education available at some of the large market maker brokers.

Demo Account: Pepperstone offers an unlimited demo account allowing prospective traders to practice trading in real-time. New traders can also explore the full suite of customisable tools and features that the MT4, MT5, and cTrader platforms offer to enhance trading performance.

Educational Resources: Pepperstone offers various educational resources, including free trading guides, articles on how to trade Forex and CFDs, various courses, and videos. Its guides cater to beginner, intermediate, and advanced traders. It also hosts regular webinars, and archives of previous webinars are available for free on its website. Trading guides cover topics such as ‘the Psychology of Placing Your First Trade’, Forex Trading Basics and how Forex trading works, and introductions to various trading strategies. It also offers MetaTrader4 and Forex trading courses.

Webinars: Weekly webinars pick up where the structured education stops, with more detailed strategy sessions led by expert traders. The webinar subjects vary from trading strategies to technical and fundamental analyses. Note that one has to register a Pepperstone account to access the live webinars.

Education Comparison:

Pepperstone’s Market Research and Analysis

Pepperstone’s market analysis is less frequent than many other large international brokers, but the quality is excellent and available in both video and text.

Analysis Blog: The in-house Pepperstone research team runs a regular blog covering both fundamental and technical analyses. The research provides information on market-moving events outside of conventional news sources. The research team also provides a ‘Daily Fix’ – a day-to-day analysis of events affecting the markets.

FX Evolution Webinars: Market analysis and trade ideas are available in both video and text form, and the quality is invariably high and useful for traders of all experience levels. In addition, Pepperstone has partnered with FX Evolution to deliver fortnightly webinars on a range of topics based on both technical and fundamental analysis.

Research Comparison:

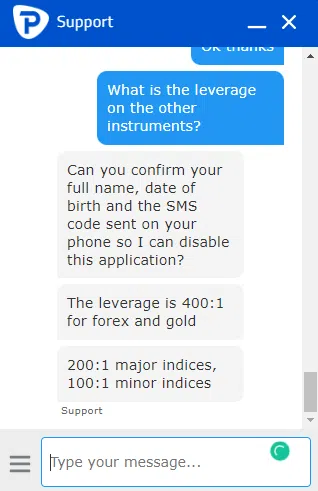

Pepperstone Customer Support

We were impressed that Pepperstone offers 24/7 support, which is unusual for an industry where the norm is 24/5.

Pepperstone’s award-winning 24/7 customer service is available to help answer questions should you need assistance with either technical or account-based queries. For the purposes of the review, we tested the live chat services. The live chat agents were responsive and highly knowledgeable. As you can see, they responded to our questions within a matter of seconds:

Regulation and Industry Recognition

Pepperstone has a long history of responsible behaviour and strong international regulation, making it a safe broker for Tanzanian traders to trade with.

Regulation: Pepperstone is regulated by the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), the Capital Markets Authority (CMA) of Kenya, the Securities Commission of the Bahamas (SCB), and the Federal Financial Supervisory Authority (BaFin) of Germany. See below for a list of Pepperstone registered companies:

- Pepperstone Group Limited is ASIC regulated with licence number 414530.

- Pepperstone Limited is regulated under registration number 684312 by the FCA.

- Pepperstone Markets Limited is licensed and regulated by the Securities Commission of The Bahamas, license number SIA-F217.

- Pepperstone EU Limited is regulated by CySEC, licence number 388/20.

- Pepperstone Financial Services (DIFC) Limited is regulated by the DFSA under license number F004356.

- Pepperstone Markets Kenya Limited is regulated by the CMA Kenya under licence number 128.

- Pepperstone GmbH is regulated by BaFin, Germany, under registration number 151148.

Awards: Pepperstone has won many awards in the industry, substantiating its credentials as a safe broker. Some recent awards include:

- Best Forex Broker 2021 (Daytrading.com)

- Best Tailored Professional Trading Conditions 2019/2020 (Professional Trader)

- Best Trading Performance Tools 2020 (Professional Trader)

- Best Global Forex ECN Broker Award 2019 (Global Forex Awards)

- Best Forex Trading Support – Europe 2019 (Global Forex Awards).

With over a decade of responsible behaviour to its clients, a large international customer base, regulation from some of the strictest authorities in the world, and a long list of awards, we consider Pepperstone a reliable and safe Forex broker.

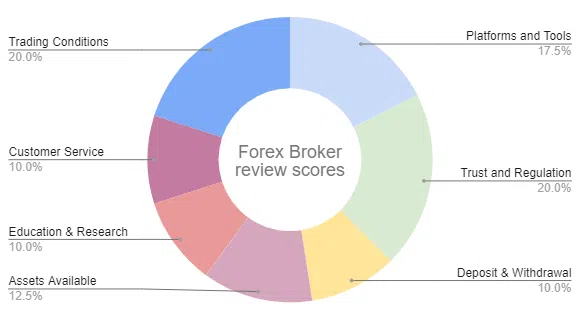

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Pepperstone Risk Statement

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Overview

Pepperstone is an internationally recognised CMA-regulated broker with high-speed trading execution and a low-cost trading environment for beginners that most NDD brokers don’t have. With all three of the major third-party trading platforms and very low spreads compared to most other brokers, Pepperstone’s clients have both the best available technology and the best available trading conditions that have earned Pepperstone its reputation. Pepperstone should be a top choice for Tanzanian Forex traders looking for a low-cost and reliable NDD broker with good education and market analysis sections, and a decent selection of trading tools.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Pepperstone stacks up against other brokers.