For over a decade, FxScouts Tanzania has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Tanzanian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

No-deposit Bonuses

Live trading with no deposit

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

TZS Trading Accounts

Save on conversion fees

-

Islamic Account Brokers

Best accounts for Muslim traders

-

ECN Brokers

Trade with Direct Market Access

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader 4 Brokers

Top MT4 brokers in Tanzania

-

MetaTrader 5 Brokers

Top MT5 brokers in Tanzania

-

cTrader Brokers

Top cTrader brokers in SA

-

Best TradingView Brokers

The Top TradingView Brokers

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- HFM - No Minimum Deposit Micro Account

- XM - TSZ Account with Tight Spreads

- Exness - High Leverage TZS Account

- FxPro - Best No Dealing Desk (NDD) Broker

- markets.com - Best Trading Platform

These are the Best Brokers with TZS Accounts

Broker | Broker Score | Min. Deposit | Max. Leverage (Forex) | Negative Balance Protection (Default) | Regulators | Trading Cost (Standard Account) | EUR/USD | USD/JPY | GBP/USD | Account Types | Trading Commission | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.53 /5 Read Review | USD 0 | 1000:1 | Yes |     | USD 10 | 0.10 pips | 0.30 pips | 0.50 pips | STP | 6 USD / lot - Zero Account | |

| 4.45 /5 Read Review | USD 5 | 1000:1 | Yes |     | USD 6 | 0.60 pips | 0.60 pips | 0.60 pips | Market Maker | Fees Included in Spread | |

| 4.32 /5 Read Review | USD 3 | Unlimited:1 | Yes |     | USD 7 | 0 pips | 0 pips | 0.10 pips | Market Maker | 7 USD/lot | |

4.39 /5 Read Review | USD 100 | 200:1 | Yes |     | USD 14 | 0.40 pips | 0.60 pips | 1.00 pips | Market Maker NDD | 9 USD / lot | ||

4.68 /5 Read Review | USD 100 | 300:1 | Yes |     | USD 7 | 0.60 pips | 0.70 pips | 1.20 pips | Market Maker | Fees Included in Spread |

HFM (HotForex) – No Minimum Deposit Micro Account

Fees and Trading Conditions: HFM is popular among Tanzanian traders looking for a low-cost TZS Account. Leverage is flexible up to 1000:1 on the Micro Account, with no minimum deposit and micro-lots are unlocked; this account is especially good for beginner traders looking to minimise risk. All trades feature STP execution, and for more experienced traders, HFM has a range of other accounts with different minimum deposits, starting at 240 000 TZS. HFM offers CFD trading on Forex, cryptocurrencies, commodities, indices, shares, bonds, and ETFs.

Regulation and Security: Founded in 2009, HFM is regulated by the FCA, CySEC, and the South African FSCA (FSP 46632).

FEATURES

- FSCA and international regulation and No-Dealing Desk STP execution

- No minimum deposit Micro Account with 1000:1 leverage

- Dedicated market analysis from in-house experts, including market news, technical analysis, special reports, and monthly outlooks.

- 24/5 customer support with toll-free local phone numbers.

XM – TSZ Account with Tight Spreads

Fees and Trading Conditions: The XM Ultra-Low Account is one of the best TSZ accounts available to Tanzanian traders. XM’s Ultra-Low Account is available on the MT4 trading platform with a minimum deposit of 125 000 Shilling (50 USD) and some of the lowest trading costs in the Forex trading industry, with spreads starting at 0.6 pips on the EUR/USD. In addition, all XM’s TSZ accounts have a maximum leverage of 888:1 and negative balance protection. If 125 000 Shilling is too much, minimum deposits start from 12 500 Shilling (5 USD) on the entry-level account, though spreads will be wider. XM offers CFD trading on Forex, stock CFDs, commodities, equities, precious metals, energies, and shares.

Regulation and Security: Founded in 2009, XM is one of the most well-regulated brokers in the Forex industry. It is regulated by CySEC, ASIC, the FCA and the IFSC Belize. Tanzanian traders will fall under IFSC regulation which allows higher leverage limits than the other regulators. Overall, XM is considered a safe broker.

FEATURES

- TSZ Accounts for Tanzanian traders, no conversion fees from TSZ bank accounts

- MT4 video tutorials: Opening an account, complex order types, and backtesting Expert Advisors.

- XM Ultra-Low account: A minimum deposit of 50 USD (125 000 Shilling) and spreads start at 0.6 pips with no commission.

Exness – High Leverage TZS Account

Fees and Trading Conditions: Exness’ Standard Account on MT4 requires a minimum deposit of 25 000 Shilling (10 USD) and has average spreads on the EUR/USD of 1 pip. This account is a good, low-risk opportunity for beginner Forex traders to get experience in the live market. The Pro Account on MT4 also has low trading costs, offering commission-free trading with spreads averaging 0.6 pips EUR/USD – but the minimum deposit is 200 USD (500.000 TSZ). All accounts feature high leverage up to 2000:1.

Regulation and Security: Founded in 2008, Exness Group has been FSCA-regulated since 2020 (FSP 51024) and offers trading on 100+ Forex pairs, cryptocurrencies, stock CFDs, indices and commodities. Currently, South African trading accounts are regulated by the Seychelles FSA, which does not require brokers to offer negative balance protection and trader’s funds may not be kept in South African banks.

FEATURES

- Nine account types for both beginners and more experienced traders

- TZS Accounts for Tanzanian clients, no conversions fees from TZS bank accounts

- Automated instant withdrawal system, with free withdrawals to e-wallets.

- TC.Technical Analysis indicator from the international analytical agency Trading Central

FxPro – Best No Dealing Desk (NDD) Broker

FxPro’s NDD execution model is available on MT4, MT5, cTrader and its browser-based platform. FxPro recommends an opening deposit of 1.000.000 Shilling, though accounts can be opened with as little as 250.000 Shilling. Features traders will like at FxPro are:

- Ultrafast NDD Execution and Platform Choice

- Tight Spreads

- Free Funding via the FxPro Wallet

✔️Fast Execution | No Dealing Desk

All trades are NDD and most are executed in less than 10 milliseconds. Only 9% of orders received negative slippage. A perfect environment for scalpers and automated trading in volatile markets.

✔️Tight Spreads | All Three Major Platforms

FxPro has three accounts, one for each of the major platforms: MT4, MT5 and cTrader. Both the MT4 and MT5 accounts offer commission-free trading while the cTrader account has a 4.50 USD commission per trade but raw spreads – down to 0.3 pips on the EUR/USD. In addition, FxPro has its own FxPro (EDGE) web platform for those that want to keep things simple.

✔️FxPro Wallet | Free Deposits and Withdrawals

The FXPro Wallet is kept separate from the trading account, so will not be considered when calculating margin or leverage – making it a risk management tool. All deposits and withdrawals from the FxPro Wallet are free of charge via all methods.

?Why Should Traders Use FxPro?

FxPro offers its clients a choice of platform and then provides the execution and simplicity that many traders crave. Fast NDD execution, tight spreads, simple funding, and complete transparency.

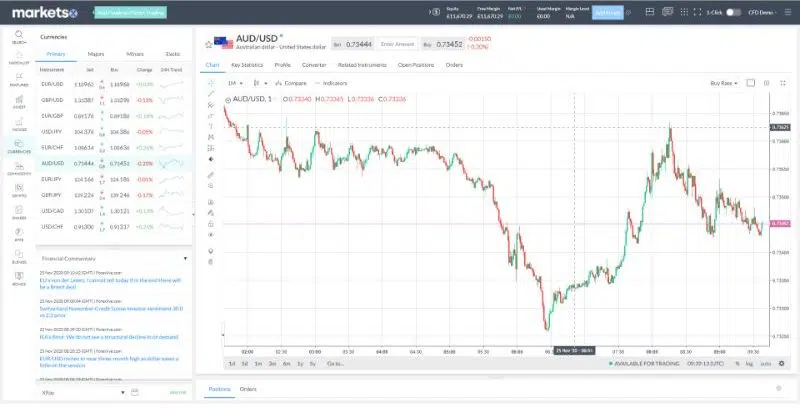

Marketsx – Best Trading Platform

Marketsx is the new trading platform operated by Markets.com. The Marketsx platform offers traders fast, commission-free trading on over 2,200 financial instruments with spreads as tight as many ECN brokers.

- Trade over 2200 tradeable instruments

- Tight spreads with no commission

- In-depth charting, asset comparison and sentiment tools

- Live-streamed, expert analysis

✔️7 Tradeable Markets | 2200 Instruments | Tight Spreads

Traders have a choice of over 2,200 instruments on the Marketsx platform. Over 50 FX pairs are available to trade with spreads starting at 0.6 pips, no commission and leverage of 1:300. Other tradeable assets include stocks, cryptocurrencies, over 25 major market indices, commodities, dozens of regional and sectoral ETFs and US, UK and German government bonds.

✔️Trading Tools and Usability

The Marketsx trading tools menu features a range of tools that crunch big data from leading analysts, hedge funds, and commentators to give traders better insight into the market. Each tool has integrated buy and sell buttons so traders can act instantly upon the information presented. In the chart view, traders can see their orders, related instruments, and open positions with a single click. Marketsx offers a clean, well-designed UI that puts the trader usability first.

?Summary – Why Should Traders Use Marketsx?

Marketsx is perfect for traders looking for an intuitive trading platform. The platform is packed full of features and analytical tools, Forex spreads are tight, and almost any other asset is available to trade.

What are the Advantages of Having a TZS Account?

The greatest advantage of having a TZS Account is that you will avoid currency conversion fees when funding your trading account.

If you have a USD trading account, conversion fees or the volatile TZS/USD exchange rate can take a bite out of your profits before you even start trading. Most international brokers will also give you a poor exchange rate from TZS to USD.

TZS Accounts will not have conversion fees on withdrawals and deposits

TZS accounts are also good for traders who use bank transfers or credit cards to fund their accounts. If you ask your bank or credit card company to fund a USD account, you can lose 7-10% of the value of your deposit in conversion charges and added fees. Fund transfers are also much quicker between local banks, so deposits and withdrawals can generally be made within 24 hours, and often happen instantly.

Funding TZS Accounts is much faster than USD accounts

Another benefit of having a TZS account is that your funds will be kept in a Tanzanian bank and will be accessible if your broker declares bankruptcy. With a USD account at an international broker, this will not be the case: Even if your funds are kept in a segregated account, they will be kept in a segregated account in another country.

TZS Accounts are usually held in Tanzanian banks

How to choose the best TZS Account

Choosing a broker with the best TZS account is much the same as choosing any Forex broker. It is essential to look at the detail of each broker to find out what differentiates them from each other. When looking for a TZS account broker, it is important to judge them on the following areas:

Regulation

Regulation is the most important aspect of selecting a broker with a TZS account, as it is with any Forex broker. You want to make sure your funds are secure and kept in a segregated account and that your broker maintains a fair trading environment.

The best international brokers tend to be regulated by the FCA, CySEC or ASIC as well as the FSCA.

The best regulators in the world are the FCA, CySEC and ASIC

Alongside FSCA regulation, brokers who offer TZS accounts will need a licence from the Bank of Tanzania (BOT) to provide financial products denominated in TZS – this extra licencing requirement adds another layer of protection for local traders.

Trading Conditions

This includes what kind of spreads are available, how much leverage is offered, and how many currency pairs are available. These factors will directly impact your profit or loss.

Trading conditions are particularly important for traders with TZS accounts as your trading balance will be denominated in Shilling. This means that when you are open a trade with the base currency in anything other than TZS (USD/JPY, EUR/USD, AUD/USD, etc.) you TZS balance will be converted in the base currency, it will be converted back again to TZS once you close the trade. This can be expensive if you plan to hold multiple large trades open simultaneously.

When trading, your account currency is converted to the base currency of an FX pair

If you are planning to trade the USD/TZS be aware that this is considered an exotic pair and spreads are much wider than for major pairs (such as the USD/GBP), often as wide as 80 or 100 pips.

Trading Platforms

Another factor to consider is the choice of trading platforms on offer. Most brokers will offer MT4, but some brokers will offer multiple platforms – each with their own advantages. Many brokers also have their own platforms, these are often easier to use for beginners, though may not have the automation options that exist on downloadable applications like MT4, MT5 and cTrader.

Broker’s own trading platforms are often easier to use for beginner traders

Minimum Deposit

For TZS Accounts, your minimum deposit will always be in Shilling. How much you are required to deposit changes for each broker and often changes between account types offered by the same broker, with higher minimum deposits often linked to better trading conditions.

Accounts with higher minimum deposits have better trading conditions

Deposit and Withdrawal Methods

All brokers accept traditional payment types such as debit/credit cards and bank transfers, many accept online payments through Skrill and Neteller.

Always check for deposit and withdrawal fees before you sign up with a broker

Always check for deposit and withdrawal fees, a few brokers charge a percentage fee for some withdrawal methods, making large drawdowns expensive.

Customer Service

Another important factor to consider when opening a TZS account is the quality of customer service offered by a broker. Brokers with TZS accounts tend to have local offices and can offer local support – which can make all the difference for beginner traders.

Brokers with local customer support will have a better understanding of your needs

Brokers with local customer support have a better understanding of the issues new traders in Tanzania have when setting up their accounts. They also can offer support in multiple languages, including Swahili.

Why are TZS Accounts so Rare?

Forex brokers who offer TZS accounts are rare, and most brokers still only offer USD or EUR accounts. This is mainly due to a lack of TZS liquidity providers. Forex brokers with TZS accounts need access to large amounts of Shilling, or Shilling liquidity pools, to cover their clients’ trades. Currently, there are just not that many banks in South Africa willing to provide the necessary funding.

Broker with TZS accounts need the support of large Tanzanian banks

Another reason for the lack of TZS accounts is that most international brokers have their costs priced in USD. By converting large sums of USD to finance TZS accounts they would open themselves up to huge exchange rate risk. They would lose money every time the TZS devalued against the USD, which has been a common problem recently.

International brokers with TZS accounts lose money when the Shilling devalues

Should I Use a TZS Account?

It depends. You will avoid conversion fees and withdrawals and deposits will be faster with a TZS account, however there will be a conversion fee on every trade with non TZS currency pairs.

Some traders want a USD account, especially traders who keep many positions open simultaneously. With this approach to trading with a TZS account, the fluctuations in the exchange rate would impact your profit margins.

One thing to keep in mind with a TZS account is whether your broker charges commission on trades – most ECN brokers do – and what currency the commission is charged in. If you have a TZS account and are being charged a USD commission for every trade, you will be losing a small amount of every trade in currency conversion. This can add up over time and become quite expensive. Most brokers with TZS accounts will charge the commission at a fixed rate in TZS but do check first.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our State of the Market Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.