As traders, we always look for trading opportunities, which are usually more abundant in volatile or quickly moving markets. Gapping markets often present very good trading opportunities, depending on the gap type.

Transcript

In the first part of this series, we’ll discuss gaps, why they occur, and how to identify them. In the second part, we will discuss how to create a solid gap trading strategy.

Gaps are caused by price fluctuations that appear as an asset’s price moves sharply up or down with nothing in between.

What is Gap Trading?

Gap trading is a strategy based on the difference between the opening candle price of an asset and the previous candle’s closing price.

Gaps can occur due to general market fluctuations or news released. Gaps are important because they represent an imbalance of supply and demand, presenting potential intraday trading opportunities.

To start off with, you need to build a Gap Trading Framework, and there are four steps to trade these gaps:

This is a Full Gap Up and occurs when the opening price is greater than the previous high price. Up gaps are generally considered bullish.

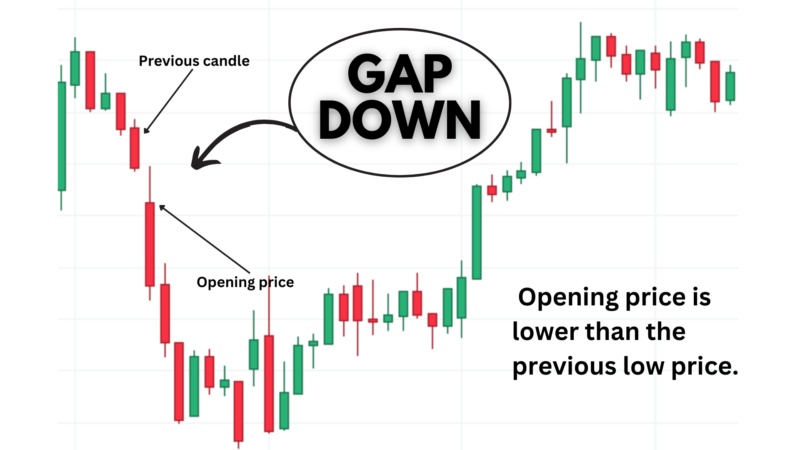

This is a gap-down, which occurs when the opening price is less than the previous candle’s low. Down gaps are usually considered bearish.

That’s the basics of gaps, but you also get four different types of gaps, which, are important to be able to identify. These include:

- Common gaps

- Breakaway gaps

- Exhaustion gaps

- Runaway gaps

Identifying the type of gap is crucial in forming your trading strategy, but identifying these gap types can be very difficult, so you have to look at some clues to identify them. Some of the key aspects to consider include the following questions:

Common Gaps

A common or normal gap is fairly uneventful. It occurs during a trading range, i.e., there aren’t any big trends happening, and there aren’t usually big market events or news that create the gap.

Additionally, these gaps get filled pretty quickly – in other words, the price will retrace back to the level where the gap occurred, and then the gap will close. The chart structure is not disrupted, and there are no support or resistance imbalances. Traders will also find that these gaps occur on low volume. While being aware of these gaps is good, it’s doubtful that they will produce trading opportunities.

Breakaway Gaps

Breakaway gaps alter price structure, breaking out of a channel, trend, above resistance, or below support.

What are the clues that this is a breakaway gap?

- There is a large gap percentage;

- It has broken an obvious technical pattern – the downtrend came to an end

- There was a good initial move – a big green candle and the beginning of the uptrend.

Runaway Gaps

Then you get runaway gaps, which occur in the middle of a trend, jumping several price levels due to extreme supply and demand imbalance.

Now, it seems difficult to know when it’s the beginning or end of the move, but you can look for some clues:

- It should not yet be in overbought or oversold territory – then you know it has room to continue the trend.

- The gap should not be at the beginning of a move up or down.

For breakaway or runaway gaps there is usually a catalyst – some news event, some announcement, or earnings release, etc. There will also be a higher trading volume during these gaps.

Exhaustion Gaps

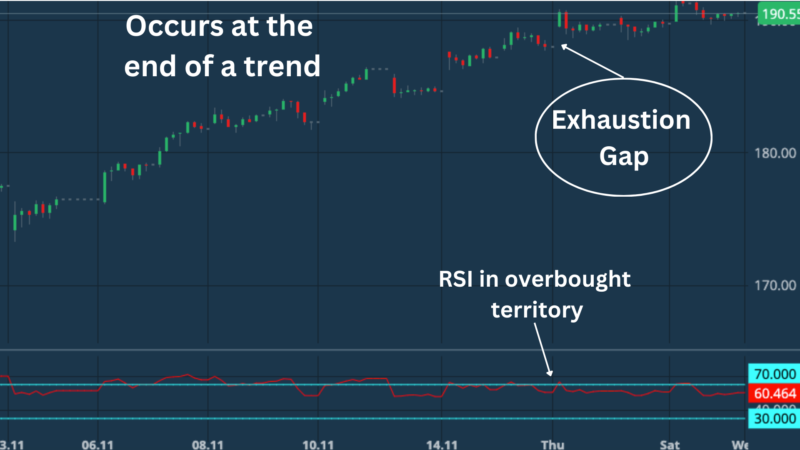

Exhaustion gaps are large gaps at the end of a trend or very extended move that either reverses the gap or stagnates.

Clues that it’s an exhaustion gap is that there may have been a trend before the gap that continued for a while, and the Relative Strength Index (RSI) and stochastic oscillators indicate very overbought or oversold conditions. These gaps often just sit and stagnate, they don’t really go anywhere.

For a gap trading strategy to work, you cannot use common or exhaustion gaps – because these don’t create good trading opportunities. You want to use breakout gaps, which disrupt the current price structure, or runaway gaps that occur in the middle of a strong trend.

In part 2 of gap trading strategies, we will discuss a common gap trading strategy called the ‘gap and go strategy,’ where you identify a potential runaway or breakaway gap, predict where the price may go, and create a plan to capitalise on it.