-

Best Forex Brokers

Our top-rated Forex brokers

-

No-deposit Bonuses

Live trading with no deposit

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

TZS Trading Accounts

Save on conversion fees

-

Islamic Account Brokers

Best accounts for Muslim traders

-

ECN Brokers

Trade with Direct Market Access

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader 4 Brokers

Top MT4 brokers in Tanzania

-

MetaTrader 5 Brokers

Top MT5 brokers in Tanzania

-

cTrader Brokers

Top cTrader brokers in SA

-

Best TradingView Brokers

The Top TradingView Brokers

-

Copytrading Brokers

Copy professional traders

-

Forex Trading Apps

Trade on the go from your phone

Going into the weekend, the USD was in the driving seat against the other major currencies. This was off the back of strong jobs data on Friday showing that the Fed’s battle to control inflation was far from over.

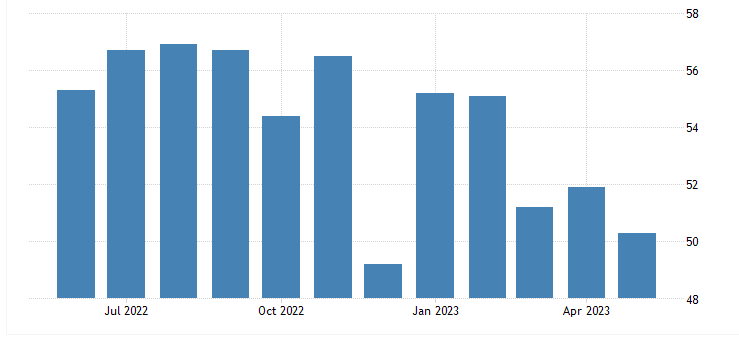

But today, we have seen a reversal following much weaker than expected ISM data, painting a more mixed picture of the US economy than Friday’s NFP release first told. According to the Institute for Supply Management (ISM), its services PMI index plunged to 50.3 from 51.9, well below expectations of 52.2, and one step away from entering recessionary territory. Any value above the 50 threshold indicates growth in the sector, while readings below that level denote contraction.

SERVICES PMI CHART (ISM)

The EUR/USD rebounded above 1.07 on the news, and the DXY was broadly lower – erasing any session gains.

Commenting on the data, Anthony Nieves, Chair of the Institute for Supply Management (ISM) Services Business Survey Committee, said, “there has been a pullback in the rate of growth for the services sector. This is due mostly to the decrease in employment and continued improvements in delivery times (resulting in a decrease in the Supplier Deliveries Index) and capacity, which are in many ways a product of sluggish demand. The majority of respondents indicate that business conditions are currently stable; however, there are concerns relative to the slowing economy.”

Markets are now pricing in a pause in the Fed’s rate hike cycle while leaving the door open for further rate hikes in the future. But, as we have seen in the recent past, this could all change very quickly. The Fed, and the investment world, are in a reactive mode currently. Any fresh data challenging the assumption that the US economy is cooling off will send the USD riding high again.

That said, if the data continues to confirm US economic weakness market will start to worry about the risk of a recession, with a knock-on effect on stocks and commodities.